JMT Capitol Edge | • Investment • Trading • Mutual Funds • SIP/SWP/STP • Wealth Management – All in One Place

Mutual Fund

A mutual fund is a pool of money. This pool is created when thousands of people like you, your neighbour, your cousin in Bangalore, and your school friend in Delhi all invest money into the same fund.

That money is then managed by a professional fund manager who invests it in stocks, bonds, or commodities, depending on the type of mutual fund. You get units of that fund, just like shares, based on the amount you invest and the day’s NAV (Net Asset Value).

Mutual funds are ideal for people who don’t have the time or knowledge to pick individual stocks but still want to benefit from the market. You don’t control where the money goes, but you benefit from the shared outcome. That’s how a mutual fund works.

Creative Vision

Types of Mutual Funds in India

There are different types of mutual funds to suit different financial goals.

Equity Mutual Funds

These primarily invest in the stock market. They are best for long-term wealth creation and are suitable if you’re okay with short-term ups and downs.

Debt Mutual Funds

These invest in bonds, government securities, and other fixed-income instruments. Lower risk, stable returns. Such MFs are ideal for short-term goals or risk-averse investors.

Hybrid Mutual Funds

These invest in both equity and debt, and thus, you get a balance of growth and stability. Suitable for new investors seeking diversification.

ELSS (Equity Linked Savings Scheme

Tax-saving mutual funds under Section 80C and have a lock-in of 3 years and offer equity-like returns.

Whether it’s sip mutual funds for a beginner or an experienced investor, these formats offer flexibility and discipline. When people search for the best mutual fund for SIP, they’re usually looking in these categories based on their needs and risk tolerance.

More Creative Vision

Benefits of

Mutual Funds

Mutual funds have many benefits for investors, especially if you don’t want to manage your investments daily. Here’s a clear breakdown:

- Professional Management

- Diversification (Risk Reduction)

- Flexibility & Variety

- Compounding Power

- Affordable Investment

- Liquidity (Easy to Buy/Sell)

- Tax Benefits

Solution we offer

Bring The Revolution With The

Diligence Service

Investment

Investment simply means putting your money , time , or resources into something with the expectation of getting a return (profit or benefit) in the future...

Trading

Trading means buying and selling something (like goods, services, or financial assets) to make a profit....

Matual Fund

A mutual fund is a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, etc. It is managed by a professional fund manager…

WealthManagement

Wealth management simply means managing someone’s money in a smart, organized way so that it grows, is protected, and can be used wisely in the future.

Examples of our work

Every Great Design Begins With

A Great Story.

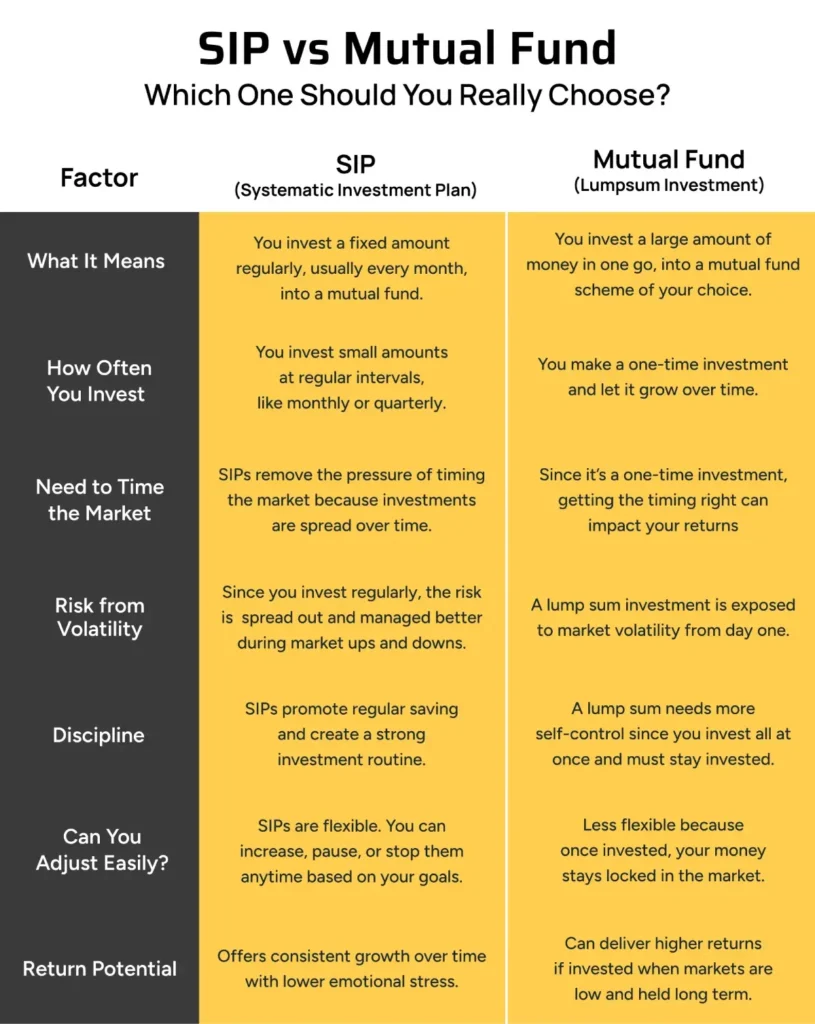

SIP vs Mutual Fund: Key Differences

A Great Story.

Many people ask, “is SIP and mutual fund same?”

The answer is no.. Here’s the real difference between a mutual fund and an SIP:

Let’s say you just got your bonus: ₹60,000. You can:

Option 1: Invest the full ₹60,000 in a mutual fund today. That’s a lump sum investment.

Option 2: Start a mutual fund SIP of ₹5,000/month in the same fund over 12 months.

Now, let’s assume the stock market fluctuates over the year. With SIP:

- In months when the market is down, you get more units.

- In months when it’s up, you get fewer units.

This averages out your cost and reduces the risk of investing at the wrong time. That’s why so many Indians prefer SIP mutual fund plans over one-time investments.

Now, which Mutual Fund Is Best for SIP?

There’s no single answer to this. But based on popularity and past performance, you have to do proper research before choosing the MF you wish to invest in!

Company Statistics

Benefits of SIP in Mutual Funds

Budget-Friendly

You can start investing with just ₹500/month. For a college student or first-time earner, this is manageable and non-intimidating.

2. No Need to Time the Market

Even top investors struggle with perfect timing. SIP removes that pressure.

3. Builds Habit

Just like your rent or EMI, SIPs instil a savings habit that compounds over time.

4. Rupee Cost Averaging

This automatically adjusts your buying price over market cycles, smoothing out volatility.

5. Power of Compounding

₹2,000/month invested for 15 years at 12% returns = ₹1

Years Experience

Happy Clients

Projects Done

Awards Won

Our Testimonials

What our client’s say about us

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Farjana Khatun

Mymensingh

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Marco Jansen

South Africa

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Virat Kohli

Delhi-India

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Ahiduzzaman

Ulipur Kurigram

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Virat Kohli

Delhi-India

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Ahiduzzaman

Ulipur Kurigram

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Marco Jansen

South Africa

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Farjana Khatun

Mymensingh

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Virat Kohli

Delhi-India

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Ahiduzzaman

Ulipur Kurigram

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Marco Jansen

South Africa

And process-centric web services. Rapidiously utilize customizedit leadership and standardized paradigms. Efficiently enable premiu m process improvements through

Farjana Khatun

Mymensingh

Pricing Plans

Choose Your Best Plans

Trading Pricing

MCX Club

Investment Minimum 50k

- Monthly - INR 3500

- Quarterly - INR 7000

- Half Yearly - INR 12000

- Yearly - INR 20000

MCX Premium Club

Investment Minimum 100k

- Monthly - INR 5000

- Quarterly - INR 12000

- Half Yearly - INR 22000

- Yearly - INR 40000

MCX Over Night Club

Investment Minimum 200k

- Monthly - INR 5000

- Quarterly - INR 12000

- Half Yearly - INR 22000

- Yearly - INR 40000

Investment Pricing

Invest Club

Minimum Investment 100k

-

Signal Frequency - Hold For 3 To 6 Month

Pricing - INR 5900

Invest Primium Club

Minimum Investment 200k

-

Signal Frequency - Hold For 6 To 12 Month

Pricing - INR 18000